Editor's note: This article was originally published at Wirepoints.org.

Gov. JB Pritzker delivered Illinois’ combined, annual State of the State and Budget Address on Wednesday. He took credit for Illinois’ “improved” finances when he released his administration’s $45.4 billion spending plan for 2023. “Illinois received two credit upgrades – the first in over 20 years,” he said. He also touted the paydown of the state’s bill backlog and celebrated an expected $1.7 billion budget surplus in 2022, “the first of its kind in more than 25 years.”

But little, if any, of the credit for Illinois’ temporary fiscal improvements belongs to Pritzker or his administration. Illinois residents will be hard pressed to find any actions the governor or the General Assembly took over the last two years that actually improved the state’s overall finances – unless last year’s $650 million tax hike on businesses can be deemed a positive. There’s been no pension reform, no regulatory relief, no rollback in the state’s collective bargaining laws and no promised property tax reform.

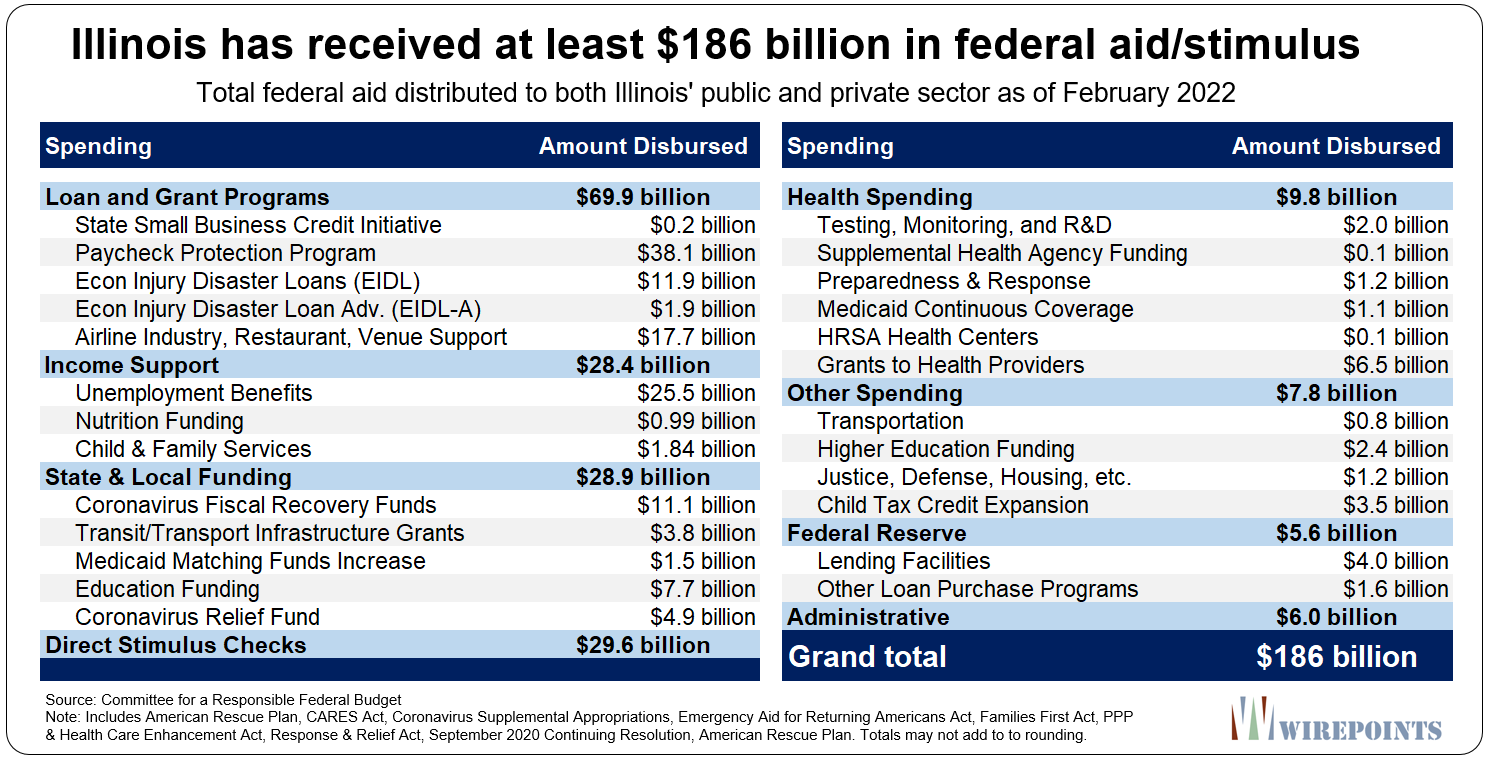

The real thanks belongs to the massive $186 billion in federal COVID relief funds that have been poured into Illinois’ public and private sectors over the past two years. It’s those dollars plus direct grants to the state that have pumped up state income and sales tax revenues in the short term, patched some budget holes, improved the position of state creditors, and more.

The impact of federal aid on Illinois

Illinois’ financial improvements can all be traced back to Illinois’ $186 billion in federal bailout funds. Knowing he’d get pushback from government watchdogs for his victory lap, Gov. Pritzker tried to dispute that fact in his address:

“Let me set the record straight for you — our state budget surpluses would exist even without the money we received from the federal government.”

How can Pritzker say that given his many pleas – and those of his party – for federal government support over the past two years? Pritzker proclaimed several times that the state’s budget and economy could not survive without federal aid.

From WBEZ Chicago: “There’s no chance we won’t have to suffer severe, damaging cuts to higher education, to K-12 education, to basic services that people need if we don’t get any support,” the governor said. “That’s what’s going to happen to our state. We’re going to see just an enormous hole where we’ve made so much progress.”

From the Chicago Tribune: Gov. J.B. Pritzker warned that the state faces ‘extraordinarily painful’ budget cuts if the federal government fails to provide states with relief funding to make up for tax revenue shortfalls caused by efforts to deal with the coronavirus pandemic.”

And consider the following:

- Illinois was the first state to beg for support from the federal government, when Sen. President Don Harmon asked for $42 billion in aid. It triggered this New York Times headline: “Illinois Seeks a Bailout From Congress for Pensions and Cities.”

- Illinois was the only state in the country to tap the Federal Reserve’s Municipal Liquidity Facility program – and was so in need, it did so twice.

- Research by Wirepoints found that Illinois was one of only a few states still running a deficit after all the federal aid prior to the American Rescue Plan was added to state budgets.

If Pritzker’s own words aren’t convincing enough, even a cursory glance at the governor’s own revenue projections shows what difference the federal bailouts made to Illinois’ finances.

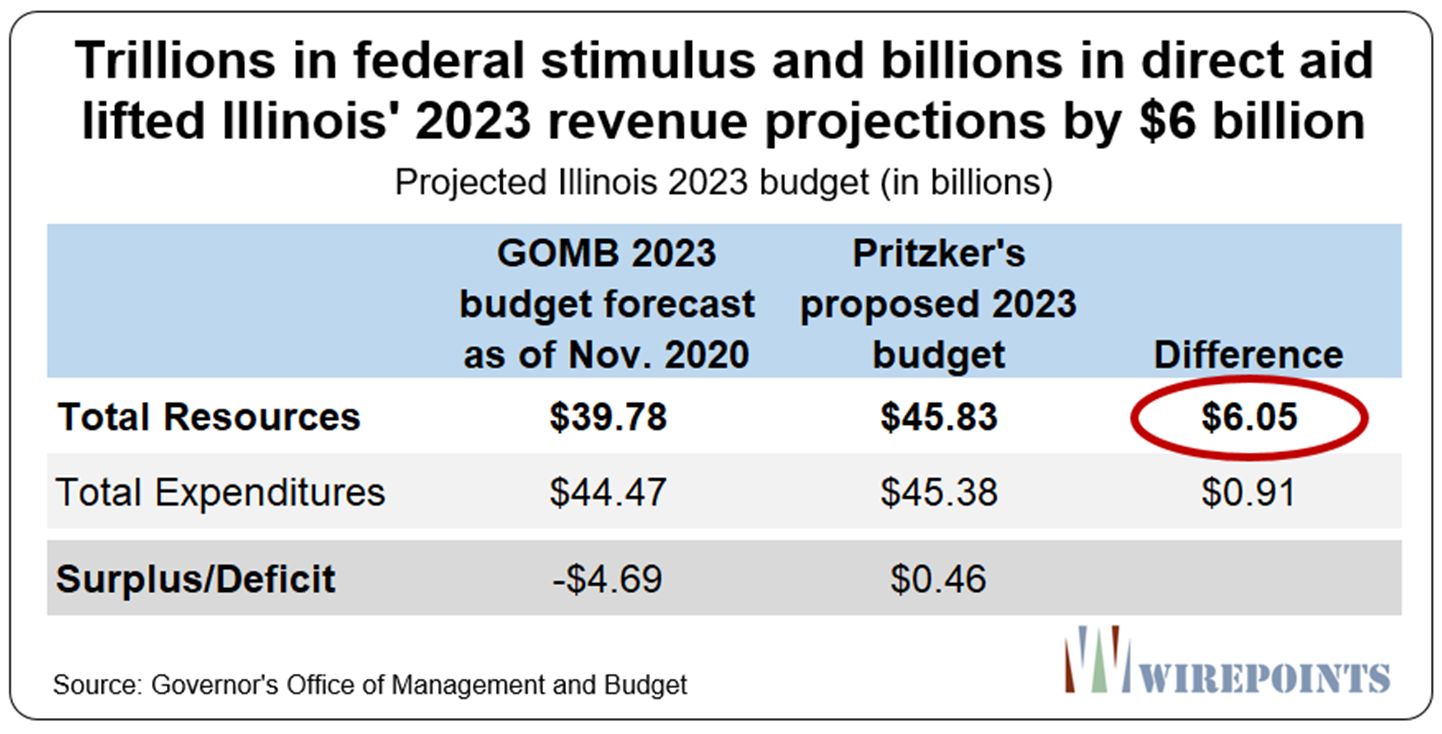

Just 14 months ago, before the American Rescue Plan became a possibility under Pres. Biden, Gov. Pritzker’s budget office projected the state would have only $39.8 billion in revenues for 2023. Today, his proposed 2023 budget projects $45.8 billion in revenues – a massive $6 billion increase.

There is little Pritzker can point to in the past year that he or the legislature did, other than the $650 million corporate tax hike passed in 2021, that explains the state’s massive jump in revenues in such a short period of time.

The only explanation is the federal government’s massive cash infusion into Illinois. About $130 billion in the hands of individuals and companies – $70 billion in grants and loans, $28 billion in income support and $30 billion in direct stimulus checks – helped spike income and sales tax revenues to record levels.

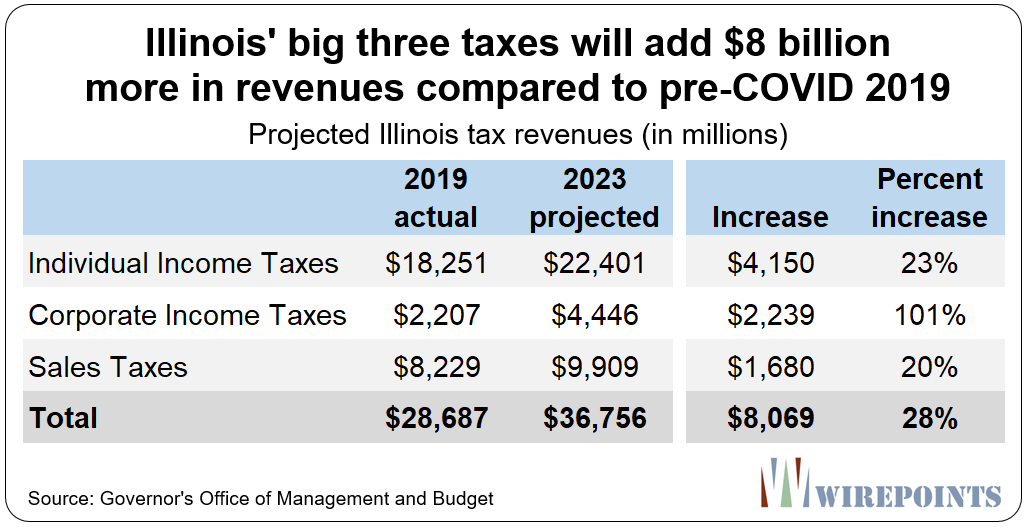

To appreciate the impact all that money had on Illinois taxes, compare Pritzker’s 2023 revenue estimates to Illinois’ pre-COVID 2019 revenues – when the national economy was booming, markets were at record highs and unemployment was at record lows.

Individual income tax revenues are up 23 percent. Corporate tax revenues are up 101 percent (72 percent when you back out the corporate tax hike) and sales tax revenues are up 20 percent. In all, the big three taxes are adding $8 billion more in revenues compared to pre-COVID 2019.

Again, Pritzker had little to do with those increases.

Pritzker’s budgets are also benefiting directly from $8.1 billion in direct aid for the state as a result of the American Rescue Plan.

There’s more, too. We count at least $3.5 billion that’s targeted to the state for coronavirus relief and another $2.7 billion in Medicaid funds. In all, that totals more than $14 billion in aid. The Committee for a Responsible Federal Budget lays it all out here.

Pension boon

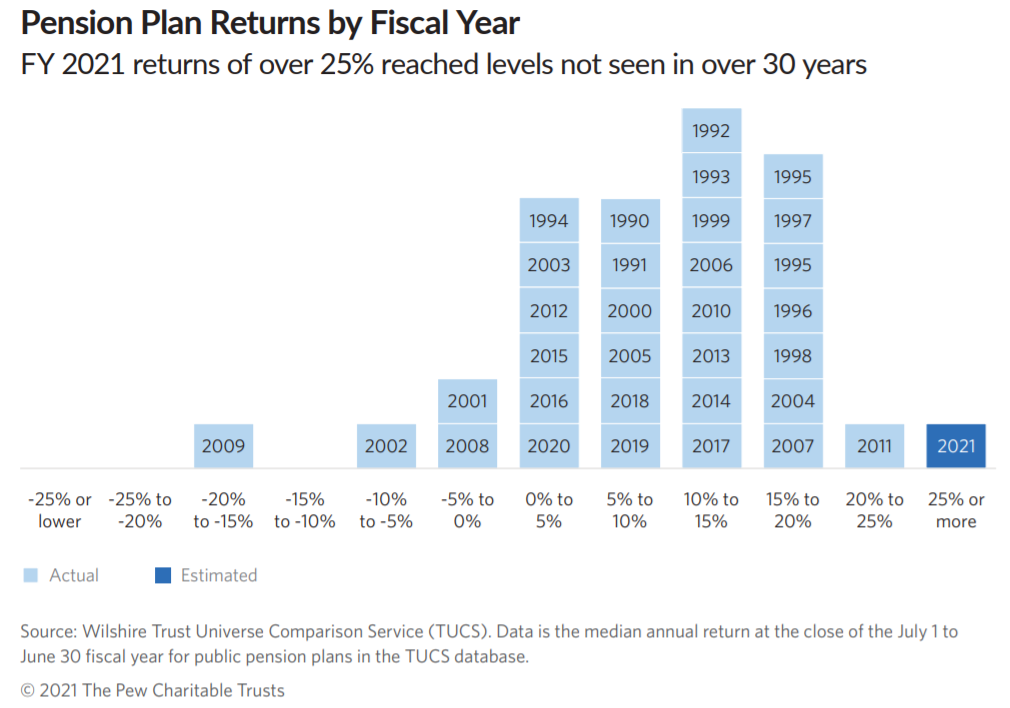

The federal bailout nationally was also a boon for state pension plans across the country. The trillions in spending found its way into the market and led to the biggest stock market returns in 30 years – what Pew called a “once-in-a-generation” jump.

In Illinois, state pension funds earned record investment returns of 23 percent or more. All that new money helped bring down the state’s pension shortfall to $130 billion in 2021, down from $144 billion the year before.

It’s worth reiterating that lawmakers did nothing to reform state pensions over the period. In fact, they only made things worse by agreeing to bigger labor contracts, increased sick leave benefits and even larger pension benefits for some municipal workers (See appendix for the full list).

Not to mention, the market can take away any gains as quickly as it gave them.

Upgrades

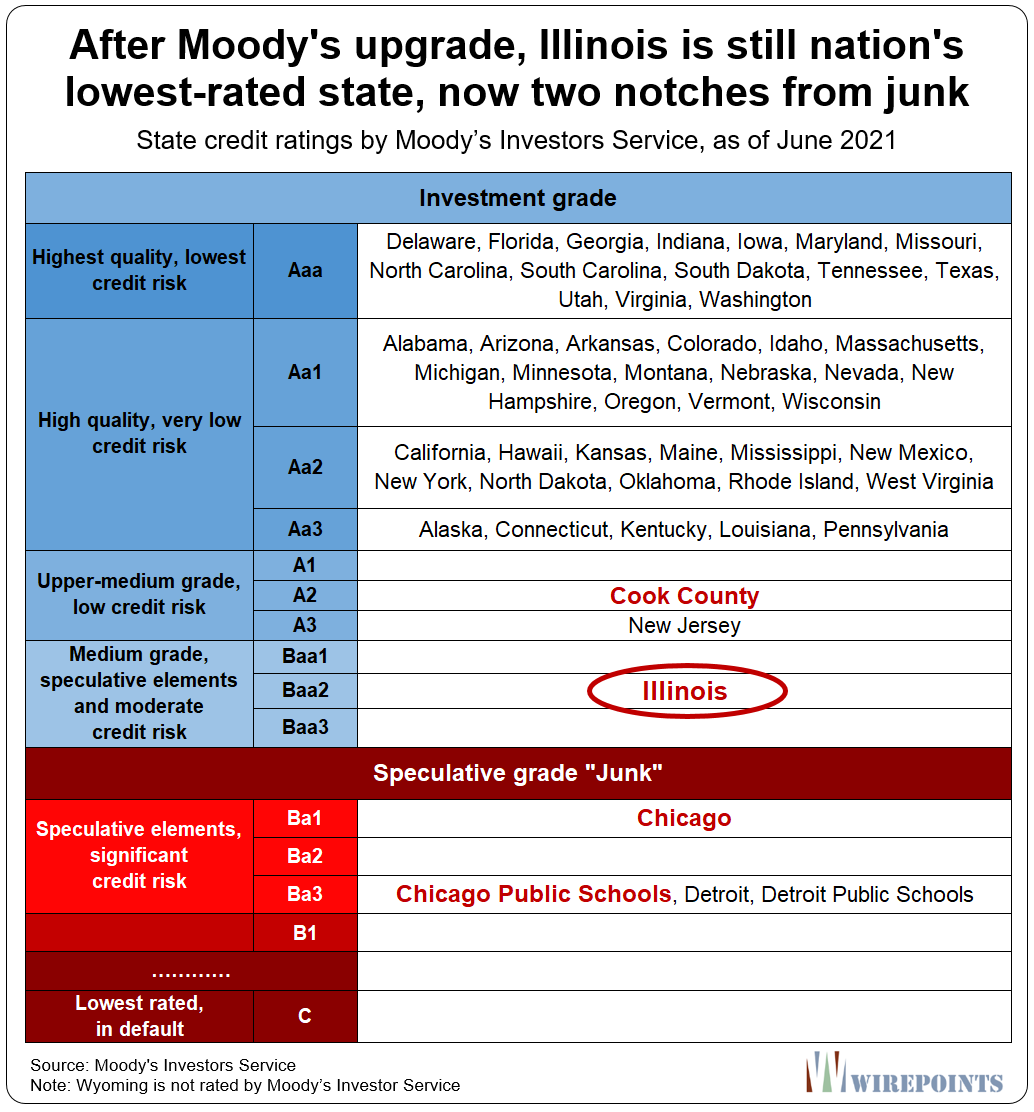

Illinois has suffered a long history of downgrades from the big three credit rating agencies – 13 under Gov. Pat Quinn, eight more under Gov. Bruce Rauner and once under Gov. Pritzker. And just before COVID appeared, Illinois was under threat of becoming the first-ever junk rated state in the country.

But more recently, Moody’s and S&P upgraded Illinois’ credit rating by one notch each.

What changed so dramatically in such a short period of time? Once again, credit the billions of dollars gifted to the state. They have significantly reduced the probability of a bond default in the near term, which is ultimately what the credit rating agencies really care about.

Note, though, that the state’s rating is still only two notches away from junk and is still the lowest of any state in the country.

**************************

**************************

A couple of points before we conclude.

First, while Illinois’ financials may be temporarily “improved” as result of the bailouts, it can’t be ignored that the federal bailouts are destructive for the nation overall. Everyone will eventually end up paying for today’s printing and spending spree through some combination of inflation, higher taxes and future cuts in services. And as Illinoisans can see from every purchase they make, the pain from inflation is already here.

Second, we’re not saying that Illinois was the only state to benefit from the federal government’s largesse. As we’ll soon write in a companion piece, every state in the country has benefited handsomely.

An honest appraisal

An honest state of the state would tell Illinoisans that the massive inflow of COVID aid is only temporarily hiding the state’s major problems. That Illinois still has the country’s worst pension crisis. That it is one of the country’s few states with a shrinking population. That Illinoisans are still punished by the country’s 2nd-highest property taxes. And that Illinois is still only two notches away from a junk rating, the worst in the country.

And an honest assessment would tell Illinoisans that the state needs massive reforms to begin fixing the above. Unfortunately, that’s not what we got from a reelection-focused Pritzker.