Editor's note: This article was originally published at Wirepoints.org

Illinois’ wouldn’t be the fiscal and economic outlier it is today if it didn’t lose so many people to other states. Illinois is consistently one of the nation’s biggest losers of people and their incomes according to the IRS, and this most recent year is no exception.

Illinois’ chronic outflow of residents has cost the state at least $25 billion in lost income and sales tax revenues over the last 20 years, including about $4 billion in 2020 alone.

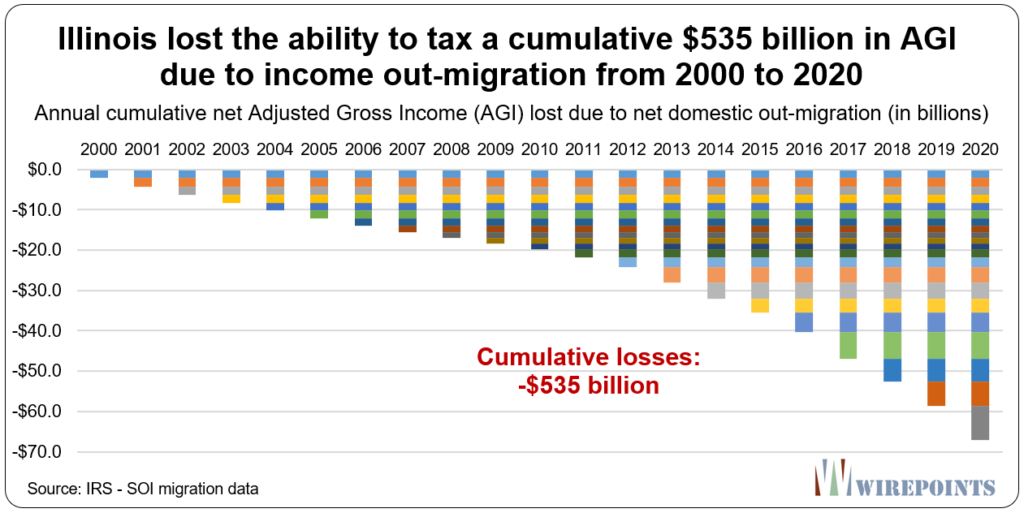

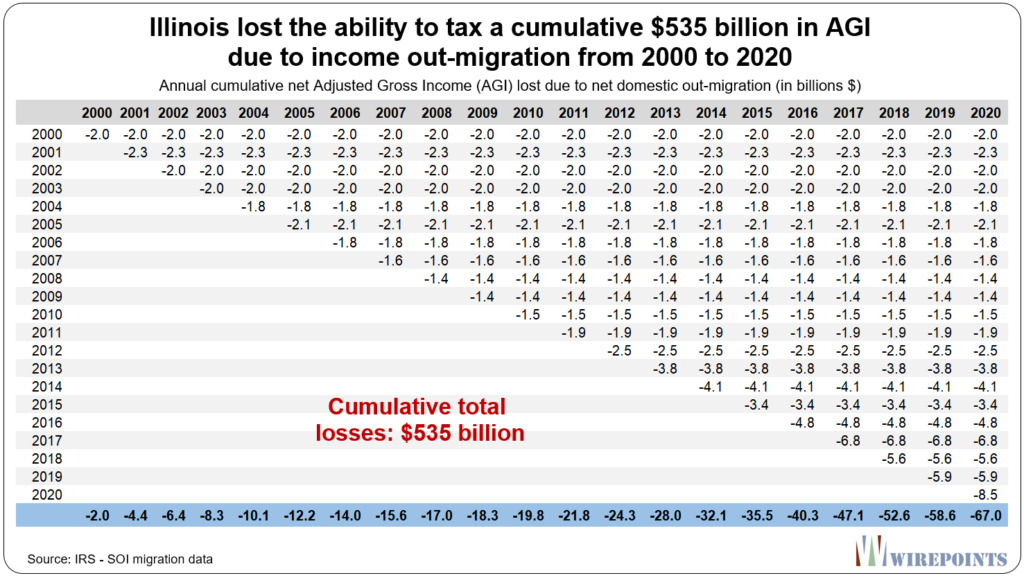

Those losses are based on IRS numbers that detail Illinois’ net loss of taxpayers and their incomes due to out-migration. When Wirepoints summed up Illinois’ losses in Adjusted Gross Income (AGI) since 2000, we found the state had lost a cumulative $535 billion in AGI that it could have taxed over the entire reported 2000-2020 period.

In this piece, we explain what two decades of fleeing residents mean in terms of cumulative income that has fled Illinois. That $535 billion in missing AGI represents not only $25 billion in forgone state tax revenues, but incalculable losses in entrepreneurship and economic activity, too.

The losses pile up on each other year after year

To fully comprehend the negative impact of losing people, you must first understand the impact of Illinois’ income out-migration over the past 20 years.

Here’s the key: The negative impact is not just how much AGI was lost in the current year. Instead, to capture the full impact in that year, you have to add up the AGI that was lost in every previous year as well.

In filing year 2000, the first year of data analyzed by Wirepoints, Illinois lost $6.6 billion in AGI due to the out-migration of 237,000 residents the previous year. In contrast, the state gained from other states just 175,000 people with a collective income of $4.6 billion.

On net, Illinois lost the ability to tax $2.0 billion of AGI in 2000.

But that’s worse than it appears. Not only was that $2 billion not there to be taxed in 2000, it was still gone in 2001 and 2002 and 2003…all the way through 2020.

In 2001, the same thing happened again. The state netted a loss of another $2.3 billion in AGI. That $2.3 billion, just like the previous year’s $2 billion, also wasn’t available to be taxed, this time in 2001 and beyond.

Illinois suffered that same situation through 2020, with the state averaging net losses of $3.2 billion in income every year – losses that built on themselves over the two decades. In 2020, the most recent reported year, Illinois lost a record net $6.5 billion in AGI.

That’s the real problem with Illinois’ chronic outflows. One year’s loss doesn’t just affect the tax base the year the income is lost, it also impacts all subsequent years. The losses pile up on top of each other, year after year.

And when a state loses incomes to other states for 21 years straight, the numbers get big. Illinois has lost a cumulative $535 billion in AGI that it could have taxed over the entire 2000-2020 period.

Illinois’ 2020 losses

Illinois’ 2020 losses

That $535 billion number is hard for anyone to wrap their head around, so let’s consider the impact of out-migration just on 2020.

In total, Illinois was down $67 billion in Adjusted Gross Income that year. The AGI losses were made up of the $2 billion that’s been missing since 2000, the $2.3 billion from 2001…all the way to the $8.5 billion gone in 2020.

If that $67 billion in AGI had never left the state – said another way, if Illinois had simply broken even over the 20 years – Illinois would have had about $2.5 billion in additional income tax revenues in 2020. That’s based on a 4.95 percent tax rate after taking deductions and retirement income into account.**

Illinois also missed out on sales tax revenues. The spending of that AGI would have generated another $1.3 billion when applying the existing ratio between the state’s total AGI and state sales tax revenues.***

Of course, the spending of that AGI would have generated a host of other tax revenues for the state as well, in the form of gas taxes, license fees, etc. Add it all up and the lost AGI cost the state at least $4 billion in lost revenues.

The same exercise in 2019 shows the accumulated lost AGI of $58 billion would have brought in $2.2 billion in income tax revenues and $1.2 billion in sales tax revenues.

Rinse and repeat going all the way back to 2000. Illinois has lost out on at least $25 billion in additional tax revenues since the turn of the millennium due to people leaving.

Reversing the flow

More than anything, those lost revenues represent the fundamental crisis this state faces because of chronic out-migration. Illinois is stuck in a vicious downward spiral it can’t hope to escape from without fundamentally changing how it governs.

Structural property tax reform, reductions in pension debt, slashing units of local government – the state needs to do all these things if it wants to convince Illinoisans to stay and persuade other Americans to move in.