What’s a surefire way to guarantee an unfair property tax hike on Illinois homeowners? Make Amendment 1 the law of the land.

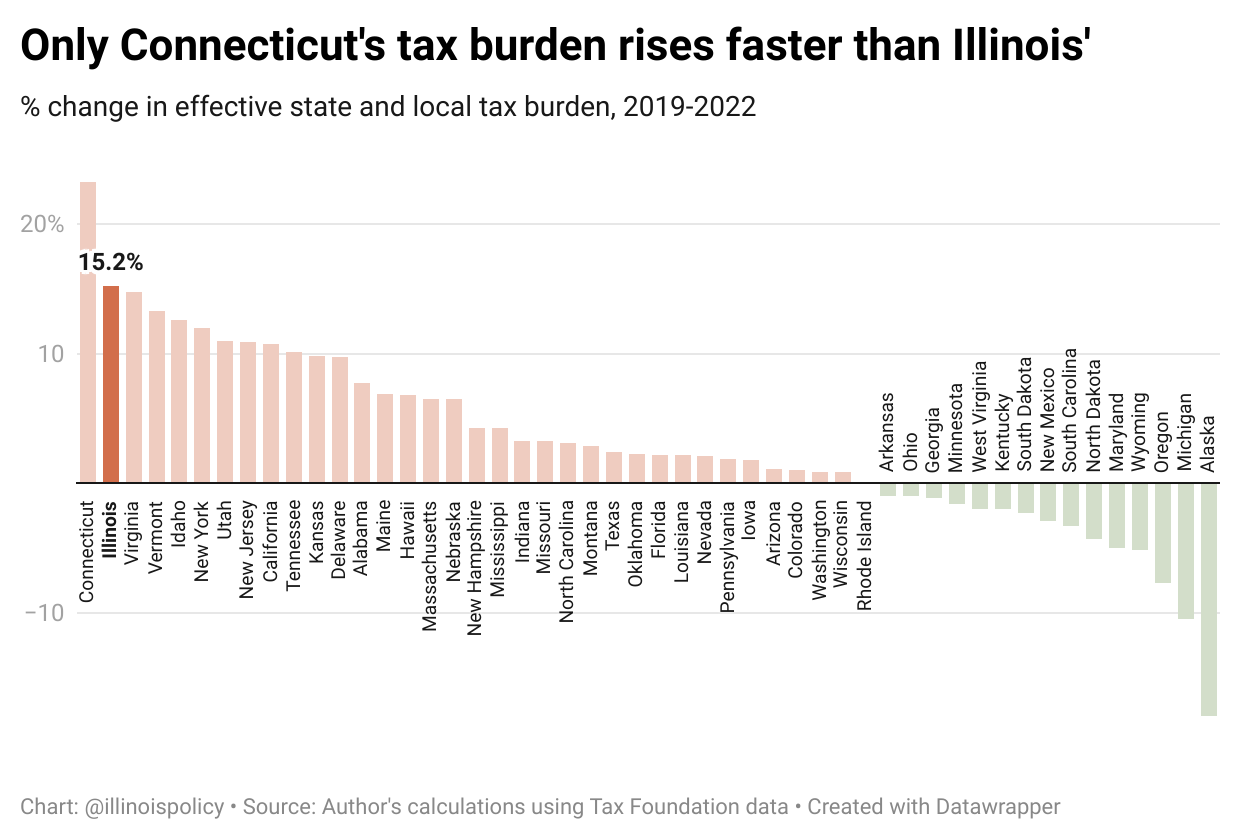

Not a great prospect for a state that’s losing population because taxes are already high.

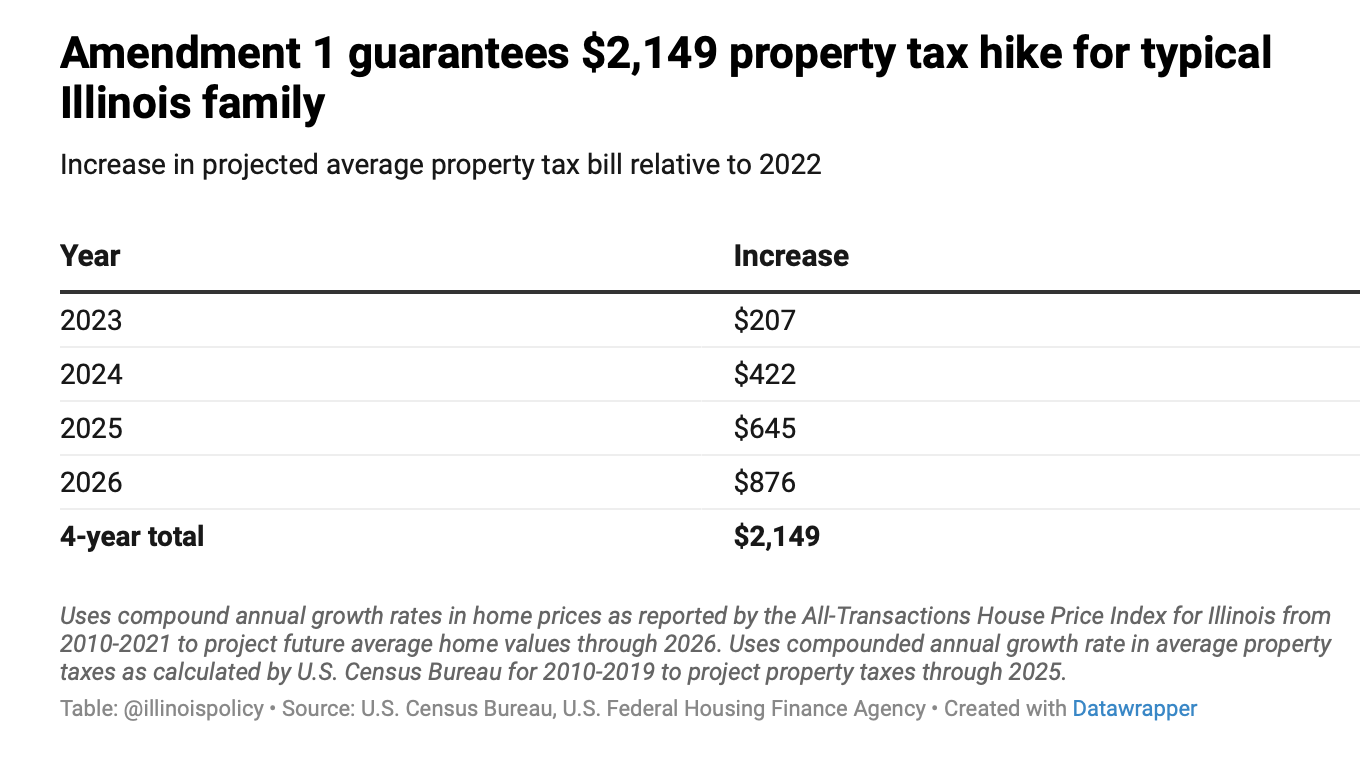

If voters Nov. 8 approve Amendment 1, also known as the “Workers’ Rights Amendment,” it would guarantee a $2,100 property tax hike for the typical Illinois homeowner.

Let’s dig into that more.

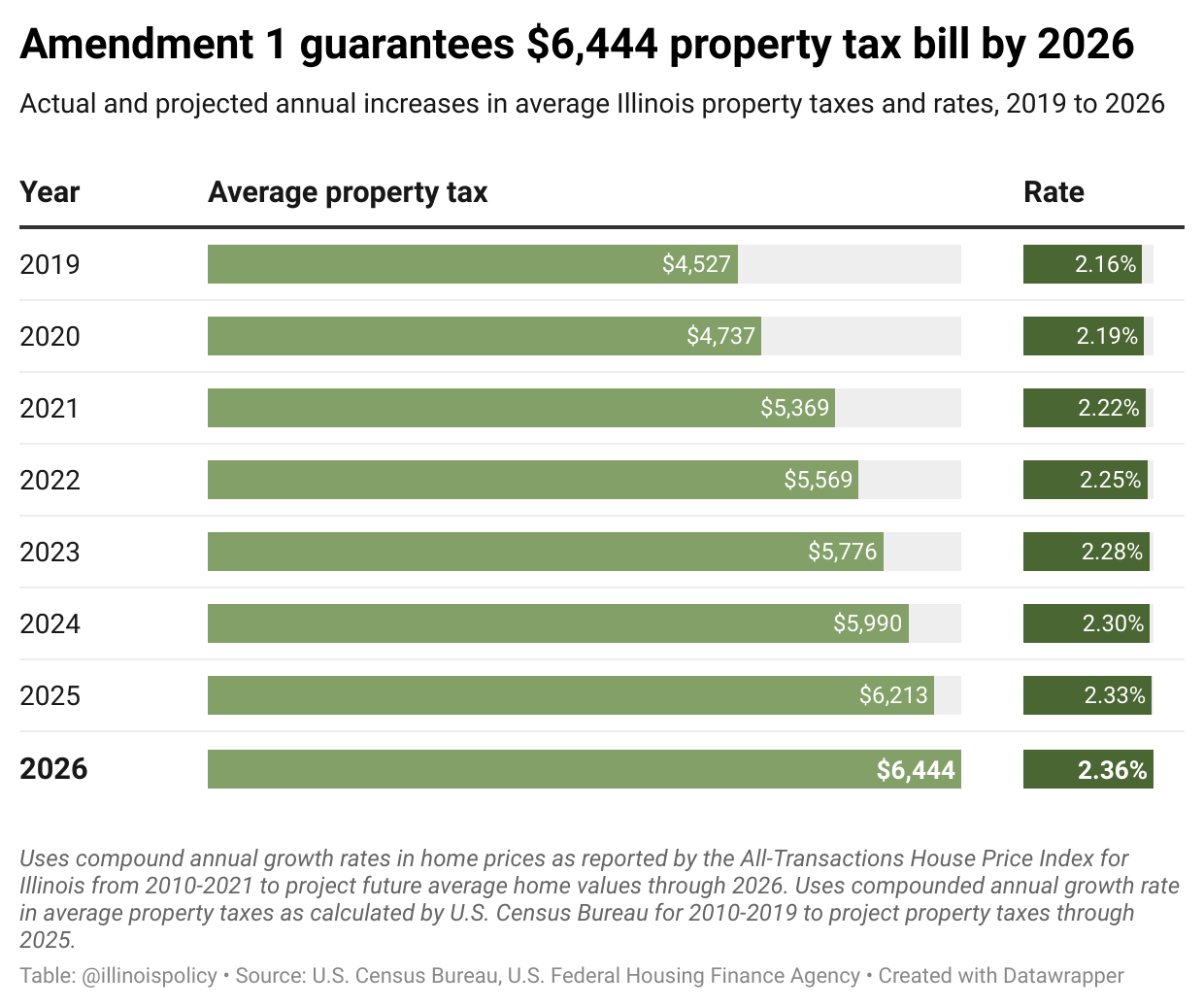

Pros or just cons? Apart from elected leaders, our ballot this year also contains Amendment 1. The proposed amendment to the Illinois Constitution would prevent commonsense reforms to reduce homeowners’ tax burdens while giving government union leaders virtually limitless new ways to demand higher costs from taxpayers. If it passes, Illinois’ trend of large annual property tax increases will likely grow faster than ever. Gov. J.B. Pritzker has failed to deliver on his promise of property tax relief during his term – the average family paid $1,913 more during his administration.

Amendment 1 would grant government unions unprecedented bargaining powers as a “fundamental right,” including the power to override voters and state lawmakers. No other state gives unions that kind of power embedded in its constitution. Proponents are selling it as a constitutional ban on passing right-to-work laws – laws that protect employees’ rights to keep their jobs without having to pay fees to a union. Illinois is not among the 27 states that currently have right-to-work laws, so that aspect has little meaning.

Amendment 1 and corruption. It’s also worth noting an Amendment 1 sponsor – former state Sen. Thomas Cullerton – was just sentenced to a year in prison for a union ghost payroll scheme.

Cullerton will still collect a $2 million pension even after spending time in federal prison for embezzlement. He’s one of eight former General Assembly members to face federal charges in the past three years.

Is this normal? Some voters may be tempted to give lawmakers the benefit of the doubt; surely these tax hikes are in line with what other states are doing, right? Nope. Some states are seeing declines, and of those that have seen increases, only one state has raised taxes more than Illinois has.

Give me the deets. The fine print of Amendment 1 is what should give voters the most pause. The amendment language includes three provisions which would weaken taxpayers’ voices in state government and make it easier for government union leaders to make unaffordable demands in collective bargaining agreements.

Research indicates property taxes could rise higher and faster than even estimated, but by how much remains uncertain. That’s because Amendment 1 would lead to unprecedented government union bargaining powers that don’t exist in any other state and is so far-reaching that it is hard to predict all the new demands on taxpayers.

When union power increases, homeowners’ tax bills tend to go up as well. The only real question is: How much?