The Cook County Treasurer’s Office is facing a class action lawsuit accusing it of discriminating against Black and Latino homeowners in the way it acquires and disposes of properties whose owners are delinquent on taxes.

Michael Bell and Michelle Kidd are the named plaintiffs in a lawsuit filed Dec. 15 in federal court in Chicago. They are joined in the action by the Southwest Organizing Project and Palenque LSNA, formerly the Logan Square Neighborhood Association, both nonprofit organizations.

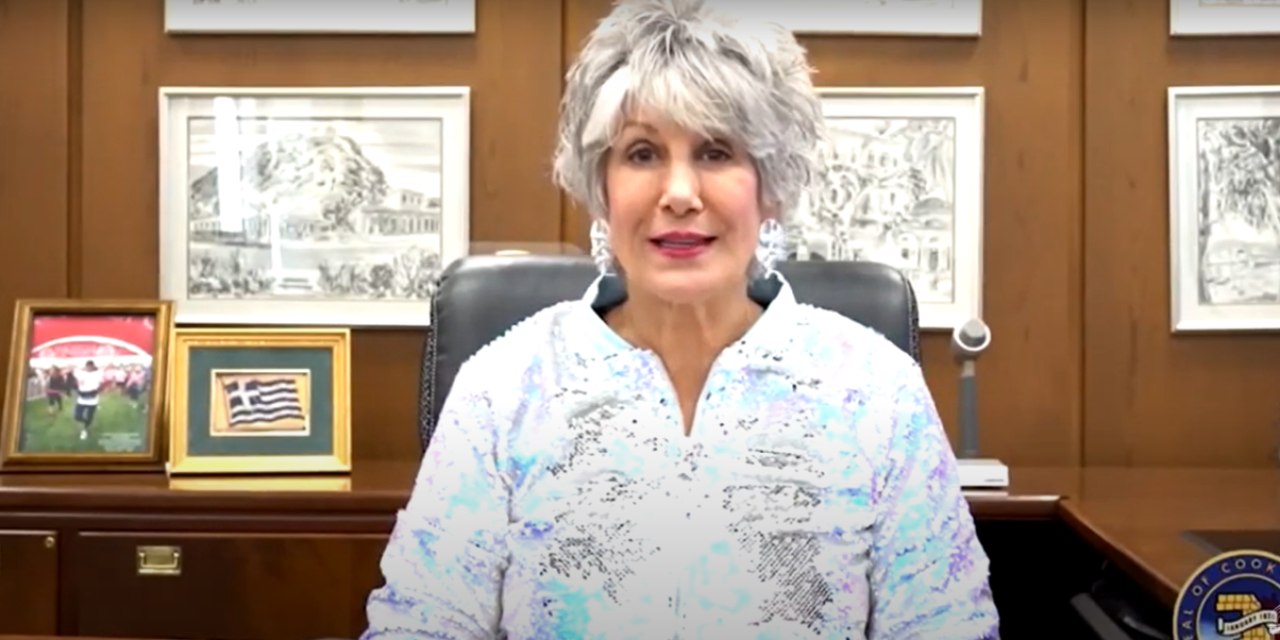

The lawsuit was filed against Cook County and county Treasurer Maria Pappas.

Brian Roche

| Reed Smith LLP

The complaint centers around the county’s use of the Illinois Property Code’s provision for unpaid property taxes. When the county sells the actual taxes to an investor, that party secures the right to the property “if the homeowner does not pay the tax buyer the amount of the taxes, plus substantial penalties and a high rate of interest by a fixed deadline,” according to the complaint. After a deadline is missed, the tax buyer can get a deed to the property “no matter how much it was worth in excess of the unredeemed taxes and related charges.”

The complaint compared the process to a traditional mortgage foreclosure sale. Under a mortgage foreclosure, if the party selling the property receives money in excess of the debt owed on the property, that difference reverts to the original owner in equity. But through the county’s process, neither the government nor the tax buyer are obligated to reimburse for lost equity, meaning “a property tax sale can ultimately result in a total loss to the homeowner of not just the home but also the entire value of the home over and above the taxes and related charges.”

As treasurer, Pappas is trustee of a county Indemnity Fund, an avenue for homeowners to seek recovery of lost equity. But the complaint asserts that fund “is effectively hidden from public view and inherently inadequate and in practice fails to provide homeowners with a fair chance to vindicate their rights."

"There is no notice of the fund and process to the homeowners; there must be a formal court filing and ultimately a trial; even blameless homeowners can be denied compensation; there are eligibility requirements that rule out some homeowners; the indemnity fund is never is adequately or sufficiently funded; and even successful homeowners must wait many years to be paid,” the complaint alleged. “In the end, vanishingly few homeowners ever receive indemnity in an amount close to the true and reasonable value of the homeowner’s lost equity. The indemnity fund does nothing to help homeowners access their home equity soon enough to help them secure new housing.”

The complaint rooted its racial discrimination claim in an alleged disproportionate effect on minority homeowners. It said that in 2021, 75% of homes sold off through Cook County’s tax sale were in Black or Latino neighborhoods, while broader population data shows only 52% of the county’s population identifies as Black, Latino or two or more races.

Bell said he spent $25,000 to buy out his brothers’ interests in their mother’s Chicago home after she died in 2017. He said the home, with a market value around $115,000, had been in the family for more than four decades, but “personal challenges and economic circumstances” made him unable to pay property taxes in 2018. In May 2019 the county sold the taxes to Lien Group LLC for about $1,650, which set his redemption amount at $11,089.

Kidd bought her Maywood home without a mortgage in 2011, when she was a full-time bus driver, and said it now is worth $230,000. She said heart disease and asthma led to her falling behind on taxes and, in 2017, the county sold her 2015 taxes to High Five Group LLC. A Cook County judge issued a tax deed on the home to the company in November 2021, and in January 2022, it moved for possession. Although she rented the home, she and her family moved out in May.

Southwest Organizing Project said the county’s policies force it to do additional work, alleging: “Every dollar and minute that SWOP expends assisting individuals who have suffered or risk uncompensated loss of their homes is money and time that SWOP would spend on its other projects and efforts. This includes efforts to fill vacant buildings, prevent non-tax-related foreclosures, improve parent involvement in their children’s education and more.”

Palenque LSNA said it has three people spending 45 to 50 hours each month helping people with property tax issues. Palenque alleged if it didn’t “have to worry about families losing their homes and livelihood, and did not have to worry about homeowners not receiving fair, speedy compensation for the lost equity in their homes, PLSNA would divert time, energy and resources towards other efforts, such as strengthening the Here to Stay Community Land Trust, doing more outreach about obtaining weatherization through the Chicago Bungalow Association, or connecting more senior residents to resources at the Center for Elder and Disability Law.”

The complaint alleged Cook County differs from other government bodies by not offering an installment option, instead giving about 30 months to pay in full before losing a home. It said a legislative investigative commission in 1976 recommended replacing the system with one that would preserve equity for homeowners, but no changes followed.

“Pappas has repeatedly acknowledged” the system’s disparate effects on “communities of color,” the complaint said, adding:

“Depriving minority homeowners of the equity in their homes is yet another example of a long-running pattern in Cook County. From the enforcement of racially restrictive covenants and Federal Housing Administration redlining policies, to unfairly high property tax assessments in Black neighborhoods, the discriminatory impacts of local officials’ decisions have undermined Black and Latino families’ wealth and stability.”

The proposed class would include anyone whose Cook County property was sold at a tax sale leading to a deed being issued to the tax buyer, with Bell and Kidd seeking to lead a subclass of Black and Latino homeowners. Formal counts include alleged violation of Fifth Amendment protections against public taking of private property without just compensation, 14th Amendment due process rights and 18th Amendment protections against excessive fines, as well as alleged violations of the federal Fair Housing Act and the Illinois Civil Rights Act.

The plaintiffs are requesting a jury trial and seek class certification, compensatory damages and an injunction preventing the county from engaging in further tax sales “without promptly and adequately providing compensation.”

Plaintiffs’ attorneys include Brian D. Roche, of the firm of Reed Smith, of Chicago; Charles R. Watkins, of Guin, Stokes & Evans, of Oak Park; and John Bouman, Lawrence Wood and Daniel Schneider, of Legal Action Chicago.