Cook County and its treasurer's and clerk's offices have beaten, for now, claims brought under a class action accusing the county and its officials of discriminating against black and Latino homeowners under the system the county uses to seize and sell off homes whose owners haven't paid their property taxes.

But an attorney for the plaintiffs said other core claims remain against the county, accusing Cook County of unconstitutionally taking their home equity. And the lawyer said they are evaluating their options for attempting to revive their other claims, as well.

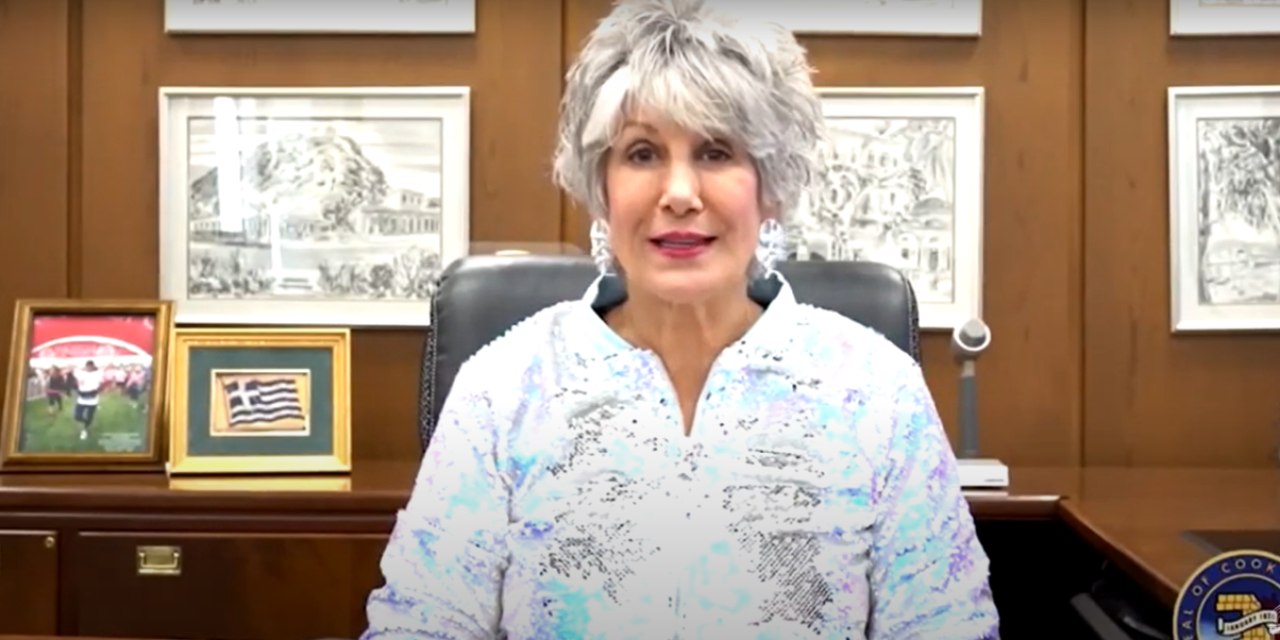

On April 19, U.S. District Judge Michael F. Kennelly tossed out discrimination claims, including disparate impact and disparate treatment, leveled under federal and state housing anti-discrimination laws against the county, Cook County Treasurer Maria Pappas and then-Cook County Clerk Karen Yarbrough.

Charles Watkins

| Guin Stokes & Evans

Yarbrough died April 7, 2024. A successor has not yet been chosen.

The ruling comes as the latest step in a court fight begun in December 2022. At that time, plaintiffs Michael Bell, of Chicago, and Michelle Kidd, of Maywood, filed suit in Chicago federal court. They were joined by nonprofit advocacy groups, including the Southwest Organizing Project and Palenque LSNA, which was formerly known as the Logan Square Neighborhood Association.

The complaint centers around the county's system, established under Illinois state law, for dealing with properties owned by people who have not paid their property taxes. Under that system, the county "sells" the unpaid tax debt to investors. That then entitles the tax buyers to demand the homeowner pay them for the unpaid property taxes, plus penalties and interest.

If homeowners do not pay by a set deadline, the tax buyers then can also seize the home under a special tax deed, no matter how much equity the homeowner had held and no matter how small the unpaid tax bill.

Under this system, homes worth hundreds of thousands of dollars can be seized and sold through the tax sale over unpaid tax bills of just a few thousand dollars.

Across the country, legal actions have multiplied in recent years against counties and other government agencies engaged in such tax sales, accusing them of unconstitutionally taking delinquent taxpayers' home equity, often far in excess of what the taxpayers may have actually owed.

Those legal claims have particularly proliferated since the U.S. Supreme Court ruled in mid-2023 in the case known as Tyler v Hennepin that tax sales can, indeed, amount to unconstitutional "equity theft."

Counties have responded by arguing the reasoning in Tyler doesn't apply to them, because, in Illinois, it is not the counties, but the tax buyers, who acquire the home equity from delinquent taxpayers.

Further, they assert the counties have so-called "indemnity funds," against which homeowners can file claims to recover at least a portion of their lost equity.

Plaintiffs in those lawsuits, however, argue it shouldn't matter if a county allows private investors to take the equity. They say ultimately it is a county that exercises the power under state law to initiate the tax sale process, and empowers the investors to seize the home.

Further, they assert the indemnity funds are essentially open secrets, as the counties don't tell delinquent taxpayers such funds exist and few homeowners know about them. Further, they say, homeowners are required to endure a cumbersome claims process, often involving a trip to court, to enforce their claims. And then, they say, homeowners rarely, if ever, recover the full value of their equity taken at tax sale.

Those cases remain pending in federal courts in Chicago and in southern Illinois.

The case against Cook County on behalf of black and Latino homeowners was filed before the Tyler ruling.

While claiming unconstitutional takings against the county and its officials, the lawsuit also included claims that the tax sale process has discriminated for many years against racial minority homeowners, allegedly exacerbating housing segregation in the process.

The complaint cited statistics from 2021 showing that 75% of homes sold through Cook County's tax sale process were in black or Latino neighborhoods, while black and Latino homeowners accounted for only 38% and 46% of Cook County homeowners, respectively.

“Depriving minority homeowners of the equity in their homes is yet another example of a long-running pattern in Cook County," the plaintiffs said in their complaint in 2022. "From the enforcement of racially restrictive covenants and Federal Housing Administration redlining policies, to unfairly high property tax assessments in Black neighborhoods, the discriminatory impacts of local officials’ decisions have undermined Black and Latino families’ wealth and stability.”

The county and Pappas moved to dismiss the discrimination claims, asserting plaintiffs didn't present enough evidence to back their accusations.

Yarbrough sought to dismiss all claims, including the takings claims, asserting she cannot be sued because her office simply followed the dictates of state law when it issued the tax deeds to the tax buyers, and had no bearing on the ultimate sale of any delinquent taxpayers' homes and loss of equity.

Judge Kennelly granted all of the county officials' motions.

He agreed that the plaintiffs' statistical assertions and their claims of Cook County's "history of housing discrimination" fall short of backing up their disparate impact and disparate treatment claims.

He noted the plaintiffs "have not identified a specific policy that is causing this disparity," noting they "provide no information about what these policy choices are, or how they are causing any disparities."

Claiming the county and its officials have shown a "lack of concern" about the alleged disparities is not enough, Kennelly said.

And the judge said pointing to Cook County's longstanding problem with racial discrimination in housing is also insufficient to demonstrate Cook County operated its tax sales and indemnification system "with a discriminatory motive."

"In this case, the plaintiffs have not plead any factual allegations that link the County's history of housing discrimination to any current policies regarding compensation for homeowners subject to a tax deed," Kennelly wrote. "The plaintiffs allege that the defendants 'have for years failed to provide compensation for equity value in excess of the tax debt when the home is transferred to a tax buyer.

"But they allege no statements or actions by the defendants tending to suggest that this failure is the result of a desire to maintain or exacerbate existing patterns of residential segregation within the County."

The dismissal applied to two of five counts in the complaint against Cook County and Pappas.

The judge further dismissed all five counts against former clerk Yarbrough and her office. He particularly noted the clerk and her office acted in accordance with state law. And he noted the U.S. Seventh Circuit Court of Appeals, which sets legal precedent for Illinois' federal courts, has ruled that county officials cannot be sued for actions they take under compulsion of state law.

"Here, as the plaintiffs acknowledge, every aspect of Yarbrough's involvement in the tax sale process that the plaintiffs challenge is mandated by state, not County, policy," Kennelly wrote. "And the plaintiffs have not identified an independent County policy or practice that governs the issuance of tax deeds or any other county clerk actions in the tax sale process.

"Furthermore, the plaintiffs have not alleged that Yarbrough made any discretionary choices that render her, or by extension the County, responsible for any constitutional violation that allegedly occurred."

Plaintiffs’ attorneys include Brian D. Roche, of the firm of Reed Smith, of Chicago; Charles R. Watkins, of Guin, Stokes & Evans, of Oak Park; and John Bouman, Lawrence Wood and Daniel Schneider, of Legal Action Chicago.

In response to the ruling, attorney Watkins noted the decision "leaves intact the constitutional takings claims against" Pappas and Cook County.

Watkins also served as co-counsel in the Tyler case before the U.S. Supreme Court and is co-counsel on a legal action filed last year in Chicago federal court against eight counties, including several of Cook County's neighbors: DuPage County Kane County, Lake County and Will County, among others.

"We are evaluating our next steps in the continuing litigation, but do want to emphasize we remain committed to eliminating the racially discriminatory and unconstitutional practice of taking people’s home equity based on non-payment of small amounts of property taxes," Watkins said.